Covered Call strategy works great in downtrending or rangebound markets: short call legs have positive expected profit and decrease the overall portfolio volatility.

However, in the Bull Markets, it does not so look attractive, at the first glance: with uptrending price, the short call leg often expires in-the-money forcing the underlying security to be called out and not to participate in the market rise above the call strike. Overall, in bull markets, calls are underpriced on average and the short call strategies have negative expected profit.

This research is devoted to finding the answer to the question: can a Covered Call strategy be efficient in the Bull Market environment despite the fact that it has an expected profit less than a simple Buy&Hold of the underlying security.

The conclusion is yes, the Covered Call strategy, especially with calls in the ITM area, can be quite efficient due to the substantially lower volatility of returns and higher risk-adjusted performance. By means of leveraging, it is possible to achieve higher absolute return than with an outright Buy&Hold strategy while having the same risk level measured by standard deviation and maximum drawdowns.

In this research, we will analyze the Covered Call for the SPDR S&P 500 ETF (SPY). It turns out all other major US equity indices demonstrate very similar results: Dow Jones Industrial Average (DIA), Russell 2000 (IWM), Nasdaq-100 (QQQ), and even equity index of the developed countries excluding US and Canada - MSCI EAFE (EFA).

For our analysis, we have taken 4-week (20 trading days) SPY call options and calculate the Covered Call performance metrics for the recent bull market started in March 2009. At the time of this research writing (November 2017), it was still continuing. Two previous bull markets, Sep 93 - Apr 00 and Mar 03 - Nov 07, demonstrated the similar results; therefore, we will present all the findings just for the recent one.

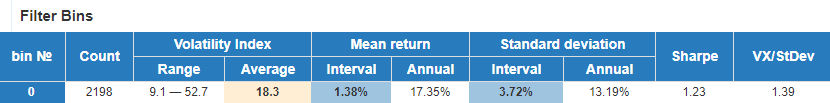

The statistics of the underlying returns for the period of March 2009 - November 2017, without any filtering, is the following:

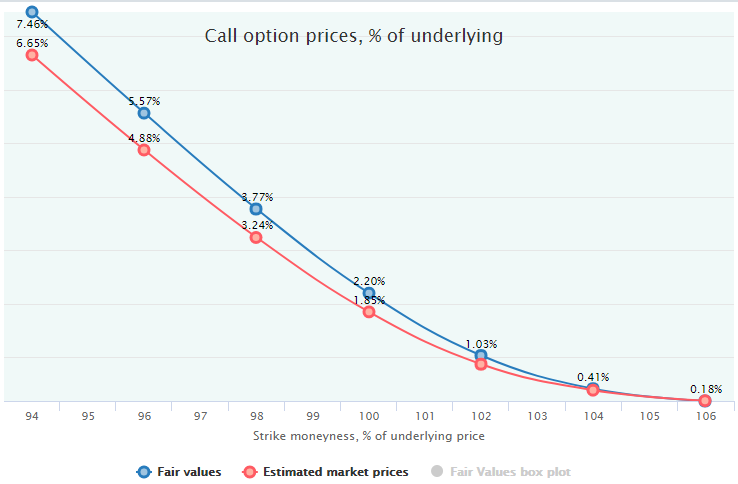

The comparison of the Fair Values vs Estimated Market Prices of our 20-day call options reveals that they are mostly underpriced by the market, especially near-the-money and in-the-money:

The reason of that is, obviously, the strong uptrend with the average underlying return of 1.38% per 4-week interval (17.35% annualized). If we remove this trend from the underlying data, the picture will be the opposite, see example in the post: Driftless Fair Value of options.

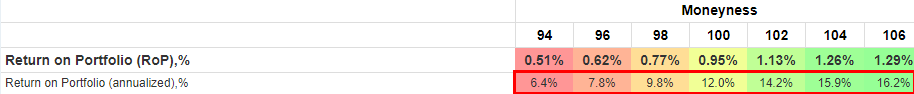

If we also look at the performance metrics of the Covered Call strategy in this period, they will be not so impressive at the first glance:

Definitely, having the average return of SPY 17.35% annualized, this performance does not look appealing, especially in ITM zone. For the reason why the "overwriting" of the long equity positions with call options can impose a drag on the overall performance, see here.

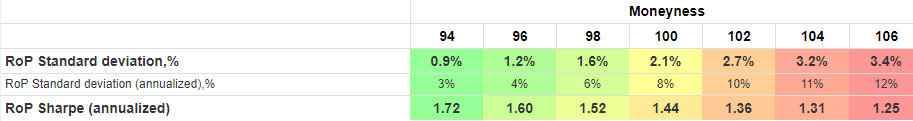

However, such a low profitability comes with substantially lower volatility and, hence, much higher Sharpe ratio:

Pay attention to the ITM strikes. The standard deviation there resembles the short-term bond volatility (3-4% annually) while having substantially higher returns (6-8%).

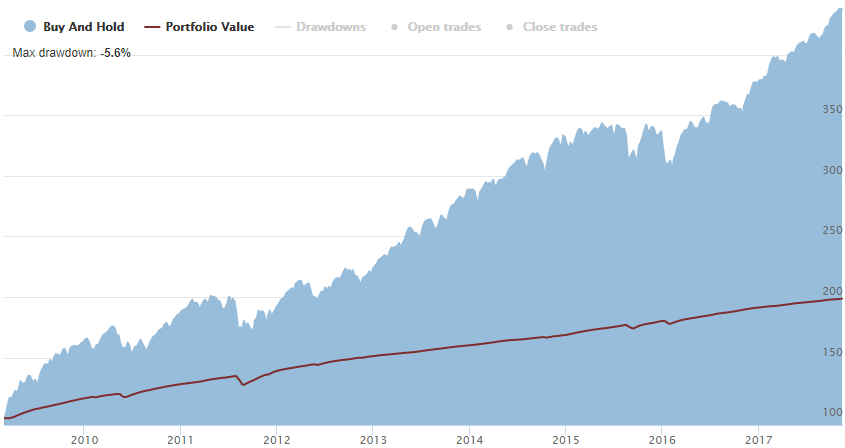

That low volatility of returns must "straighten" the equity curve of the Covered Call strategy, which is evident in this chart (96 moneyness, 20 Laddering, with compunding):

Relatively to the Buy&Hold, that equity curve looks like a straight line without meaningful fluctuations.

That leads to the obvious temptation to increase the profitability by applying the leverage to this Covered Call strategy.

Leveraging the portfolio will increase both its profit and volatility with the same proportion. However, we have initially quite a good Sharpe ratio (1.6) that will remain the same even for the leveraged strategy.

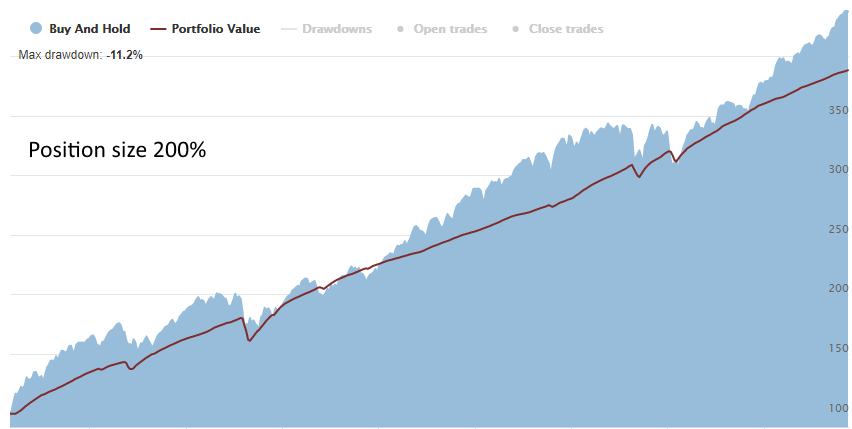

Here is the 2x leveraged portfolio:

Annualized Return on Portfolio is 15.6% with standard deviation 8%.

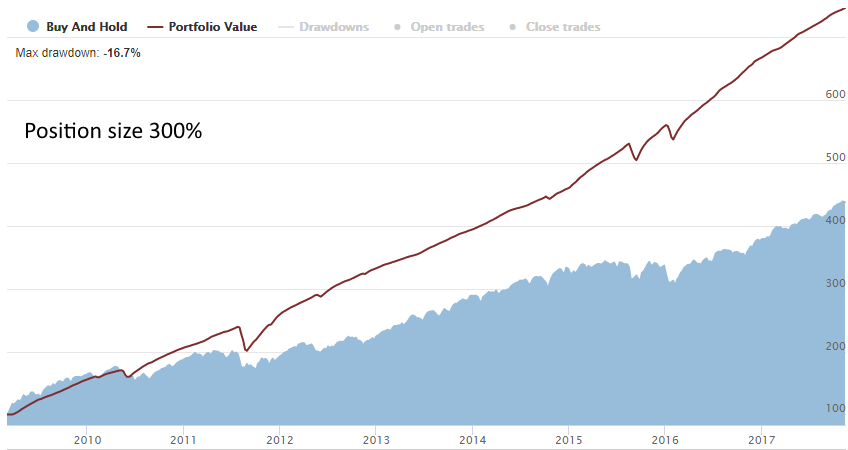

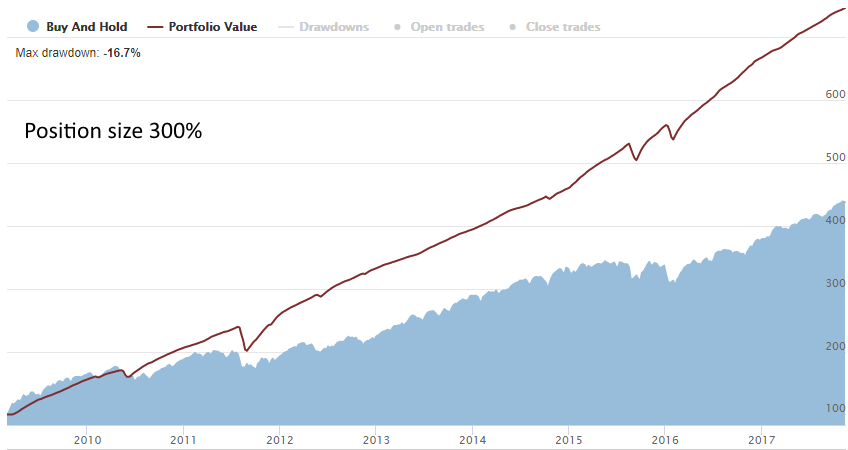

This is the 3x leveraged equity line (achievable with index futures):

That Portfolio has an impressive 23.5% Annualized Return with a standard deviation of 12%, which is even slightly less than a Buy&Hold volatility of returns.

So, having a low volatility of returns, we can take a leverage to increase the absolute profitability while leaving the risk-adjusted metrics at the same, rather high, level.

Another way to improve the performance is to play with a strike for the short call leg.

The most common way to construct a Covered Call is to sell out-of-the-money options to minimize the probability of ITM expiration and the call-outs of the underlying security. However, our analysis demonstrates (see above) that this choice is not optimal, and OTM short call legs add almost nothing to the whole performance: they do not add to the profitability and do not suppress the volatility.

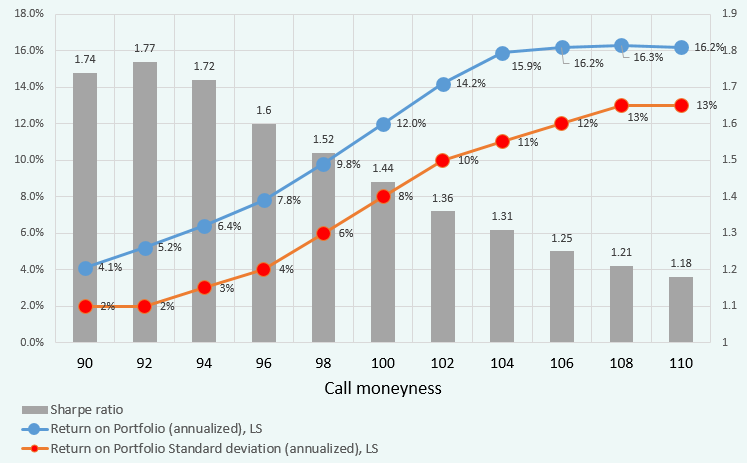

This is how the Profit/Loss and the respective volatility look like for the different call moneyness of the Covered Call strategy:

By moving from the center to the left, ITM side, we inevitably sacrifice some return; however, the respective standard deviation also drops and quite steeply. That lifts the Sharpe ratio, improves the risk-adjusted performance, and allow us to use leverage to enhance the absolute return metrics.

So, the most optimal call strikes for the Covered Call strategy lie in the ITM area. The problem here is less liquidity and wider bid-ask spreads in the ITM area. In addition, it is necessary to handle the ITM expirations which are highly probable in this zone (90-94 moneyness of these 4-week options expires in-the-money with 98-94% probability).

Despite all that, such a strategy can be quite attractive in terms of the risk-adjusted performance - even in the Bull Market environment when a short call strategy has negative expected profit.