Options Fair Value is an expected payoff of a contract. To calculate it, we use some probability distribution of the underlying returns that we derive from the historical data. However, the key question here is whether the past data is a reliable source for predictions and can we base our investment decisions on such probabilities.

In this research, we use so-called “out-of-sample” technique to figure out if our methodology for finding Fair Values is a valid approach for predicting the future payoff of options. For that purpose, we chose some fixed Fair Value for a contract with some DTE and check if the average future payoff of this contract converges to the Fair Value that has been selected initially. By doing this, we avoid the “look ahead bias” in our calculation.

The results we have achieved are encouraging: the average payoff of option contracts demonstrates quite a good conversion to the Fair Value calculated on the past data. It is more stable for near-the-money and in-the-money contracts where the probability of ITM expiration is high and options expire in-the-money quite often. For the deep out-of-the-money options, which have fewer ITM expirations, this convergence is less stable (on the relative basis).

For the practical purpose, the outcomes of this study confirm the validity of the Fair Value calculation methodology as well as the estimation of the market mispricing and, hence, the expected profit/loss of a trading strategy in the OptionSmile platform.

Put options on broad-based equity indices are systematically overpriced as measured by the expected profit of buying or selling them. Market prices for put options are usually higher than their Fair Values because of the volatility premium demanded by option sellers as compensation for high volatility and the potential for huge drawdowns. For more information, see this research: Are puts really overpriced?

However, since an expected value (all possible outcomes weighted by their probabilities) is always calculated as an arithmetic average, options Fair Values and their respective expected profit/loss do not reflect the compounding effect of returns. At the same time, we know that drawdowns have a negative impact on the total return if we capitalize all gains and losses (volatility “drag”), see more information in this post.

Theoretically, if an option seller bears this “drag”, a buyer, on the other hand, should benefit from removing this excessive volatility from his or her portfolio. In practical terms, with a long put option strategy as a hedge to a long equity portfolio, an investor can use the realized proceeds from put options at the time of a market crash as “dry powder” to buy more underlying assets at lower prices. This is also known as a “rebalancing bonus”, which is the opposite phenomena to the volatility drag.

In this research, we have studied whether put options overpricing is justified by this rebalancing bonus for a hedged portfolio. The results show that it is not. It turns out, there are no parameters (moneyness, DTE) of put options and put spreads that would make them an efficient hedge in the long run without predictions of market turmoils.

Despite the fact that we have no listed options on cryptocurrencies yet (Feb 2018), it would be interesting to calculate their theoretical Fair Values. In fact, it is quite an easy task since we have a series of historical quotes of an underlying cryptocurrency.

According to the OptionSmile methodology, we just need to build a probability distribution of historical returns and then, for any given expiration/moneyness, calculate the probability of in-the-money expiration (Pitm) and conditional expected value (payoff) in such expirations (EVitm).

That is just a theoretical exercise, of course, without a practical application. Not only due to the absence of an opportunity to trade these contracts but also because of the huge diversity of market regimes that took place in the past for these assets. Combining together the prolonged periods of extreme uptrends and the following crashes will inevitably produce a mixed bag of regimes that will have quite a poor prediction power.

Nevertheless, it is still interesting to look at the results in comparison with the regular, more mature instruments like stocks and ETFs. Just for the sake of curiosity.

Covered Call strategy works great in downtrending or rangebound markets: short call legs have positive expected profit and decrease the overall portfolio volatility.

However, in the Bull Markets, it does not so look attractive, at the first glance: with uptrending price, the short call leg often expires in-the-money forcing the underlying security to be called out and not to participate in the market rise above the call strike. Overall, in bull markets, calls are underpriced on average and the short call strategies have negative expected profit.

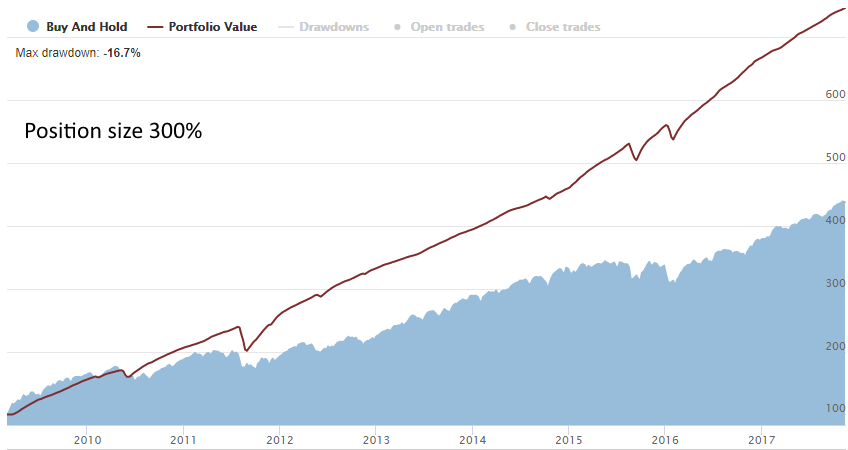

This research is devoted to finding the answer to the question: can a Covered Call strategy be efficient in the Bull Market environment despite the fact that it has an expected profit less than a simple Buy&Hold of the underlying security.

The conclusion is yes, the Covered Call strategy, especially with calls in the ITM area, can be quite efficient due to the substantially lower volatility of returns and higher risk-adjusted performance. By means of leveraging, it is possible to achieve higher absolute return than with an outright Buy&Hold strategy while having the same risk level measured by standard deviation and maximum drawdowns.

There are various pieces of evidence exist confirming that put options on wide equity indices are permanently overpriced by the market. The excess demand for the long portfolio protection is believed to be the main reason for this.

This research conducted using the OptionSmile platform underpins that observation and confirms that a put options selling has abnormally high expected profit.

However, on the risk-adjusted basis, such a short put strategy does not look so attractive due to the high volatility of results and regular huge drawdowns: the Sharpe ratio of a put selling, even with limited risk (spread strategy), is not so attractive and does not differ significantly from the Sharpe ratio of the outright long position in the underlying security.

Therefore, that high profitability of puts should be considered as a volatility premium rather than a market inefficiency.