All three indices have been fluctuating within the recent months’ range toward the end of the earnings season. RSI(14) was again hovering slightly above 50 mark showing neither oversold nor overbought condition.

Option prices have been keeping their move to fair values leaving less mispricing opportunities. Overall, the options market is getting back to normal: puts are overpriced (mostly OTM), calls are priced fairly.

Mispricing summary for the options with two to five weeks until expiration:

| Puts | Calls | |||

| OTM | ATM | ATM | OTM | |

| SPY |

Near-term expirations – Fairly priced Farther expirations – Overpriced substantially |

Fairly priced | Fairly priced | |

| QQQ | Overpriced | Fairly priced | Fairly priced | Fairly priced |

| IWM |

Overpriced substantially |

Fairly priced |

Fairly priced | Fairly priced |

Opportunities in QQQ persisting in the previous weeks have almost gone; just OTM puts remain overpriced. Overall, some interesting mispricing is observed only in the OTM puts area for all three indices.

To make our estimation more reliable, we filter the historical data and select from the past only those dates when the market resembled the current condition (read more here). We use three filters:

We apply auto filtering for Volatility index and RSI selecting 300 days in history with the shortest Euclidean distance to their current values.

For each underlying, we select expirations on a range of 2-5 weeks. We present mispricing charts for each expiration and basic PL metrics for the best one-leg strategy (buying or selling put or call) measured by the Expected profit (annualized).

SPY has been staying within the range 260-270 again; RSI(14) level of around 50 shows no oversold condition.

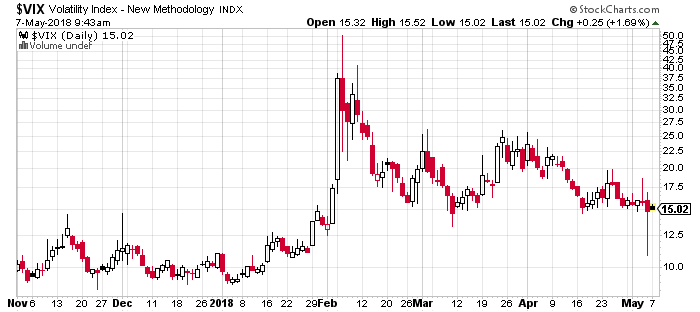

VIX remains close to the lower band of the range of the last months:

Both puts and calls are fairly priced:

Puts are overpriced but not substantially; calls are priced fairly:

Puts are overpriced, especially OTM; calls are priced fairly:

Puts are substantially overpriced; calls are priced fairly:

Short Put PL metrics for June 8 expiration:

QQQ has jumped to its upper band of the recent range driving RSI(14) closer to 60 level:

VXN continued its way down reflecting the diminishing QQQ options IV:

Puts are overpriced calls are underpriced but not substantially:

Mispricing of puts and calls is not statistically significant:

Puts are significantly overpriced only OTM; calls are priced fairly:

Puts are significantly overpriced only OTM; calls are priced fairly:

Short Put PL metrics for June 8 expiration:

IWM has moved higher but remains below highs of the recent months. RSI(14) demonstrates neither oversold nor overbought condition:

RVX remains near the lows of the recent months:

Both puts and calls are overpriced but not significantly:

OTM Puts are substantially overpriced, ITM puts are priced fairly; calls are overpriced but not significantly:

Puts are overpriced mostly OTM; calls are overpriced but not significantly:

Puts are overpriced mostly OTM; calls are overpriced but not significantly:

Short Put PL metrics for June 1 expiration: