Filter Bins

The Filter Bin is a collection of days in the past gathered into one distinct set by means of filtering. Each bin contains the days in history on which the filtering parameter values were within the range set in the Filters Selector of the Control Panel.

For example, filtering by the Volatility Index (VX) with steps 0 – 14 – 20 – 100, would allocate all the days in history into 3 Filter Bins:

- Bin 1 with all days when VIX was in 0 to 14 range

- Bin 2 with VIX in 14 to 20 range

- Bin 3 with VIX in 20 to 200 range

Bin 0 always contains the days with the widest range of the filtering parameter, e.g., with VIX 0-200 in the above example. That bin is always displayed even if no filters are applied.

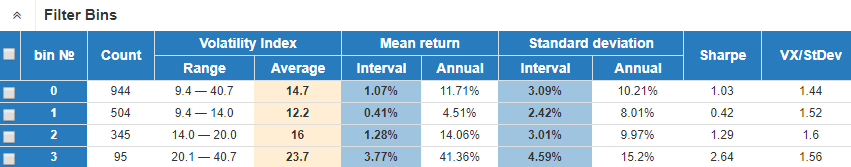

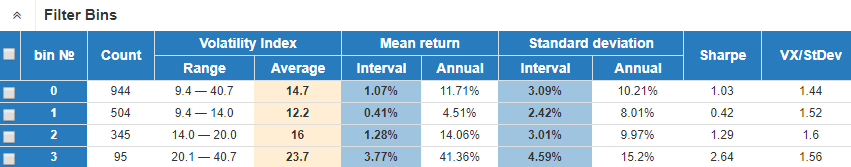

Here is an example of the Filter Bins for SPY as an underlying security, 23 trading days interval for the period of 1 Jan 2014 – 1 Sep 2017 with VIX filtering steps 0 – 14 – 20 – 100. All bins and the respective characteristics are presented in rows, one per Filter Bin:

Columns of the table:

- Count – the number of days in the respective bin. In this example, Bin 0 contains 944 trading days, Bin 1 – 504 trading days, etc.

- Volatility Index (VX) of a bin (always shown, even without any filtering):

- Range – the actual range of VX values, min – max, within the bin.

- Average – the average value of VX in the bin.

- Mean return – statistics of the average returns of the underlying security:

- Interval – the average return for the selected time Interval, e.g., the average 23 day-returns in this example.

- Annual – the same average return but per annum, annualized without compounding, e.g., the average return for the 23-days interval is multiplied by 252/23 = 10.96, where 252 is an average number of trading days in a year

- Standard deviation – statistics of the underlying returns:

- Interval – standard deviation of the returns for selected time Interval, e.g., 23-days return in the example

- Annual – annualized standard deviation with the “square root” rule, e.g., the standard deviation of 23-days returns is multiplied by √ 252 / 23 = 3.31

- Sharpe – the Sharpe ratio calculated by the division of the annualized average return less the risk-free rate to the annualized standard deviation:

Sharpe Ratio =

Mean Annual Return – Risk-Free Rate

Standard Deviation Annualized

This value represents the amount of excess return over the risk-free rate per one standard deviation (risk-adjusted return)

- VX/StDev – the ratio of the average Volatility Index to the Standard deviation annualized, representing the relation of the average volatility that was implied by the options market prices and the volatility of returns that had actually followed. With some simplification, a ratio greater than 1 means the expected volatility was overestimated by the options market on average, and vice versa.

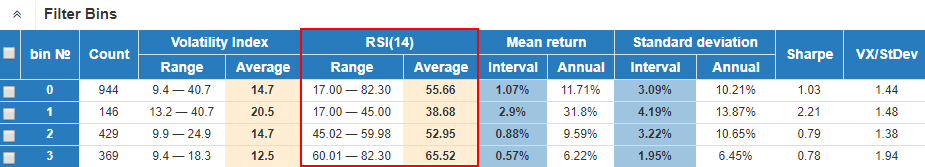

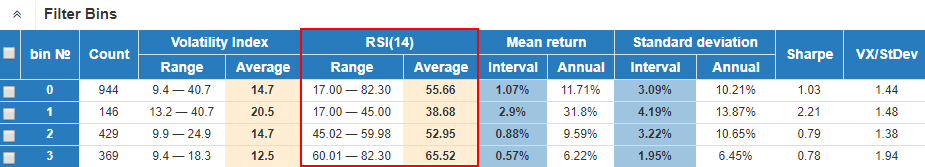

In case any filter is applied (other than VX), the respective Range and Mean values appear in the Filter Bin table in separate columns. Here is an example of the RSI(14) filter application with steps 0-45-60-100 (but without VX filtering) producing the following bins:

After clicking on any of these bins, all the information regarding that bin is opened below in the following sections:

It is also possible to compare the metrics of different bins by selecting them simultaneously in this table (checkbox in the leftmost column). In this case, only the Mispricing and the Underlying Returns Statistics sections are available for comparing the Fair Values of options and the underlying returns distributions among the Filter Bins selected.