iPath S&P 500 VIX Short-Term Futures exchange-traded note (VXX), as many other similar volatility products, has been initially designed to provide an exposure to the volatility index on S&P500 – VIX. Being included in the long-term investment portfolio, this ETN was supposed to serve as a safety buffer during the market drops and, hence, should decrease the overall portfolio volatility enhancing the risk-adjusted return.

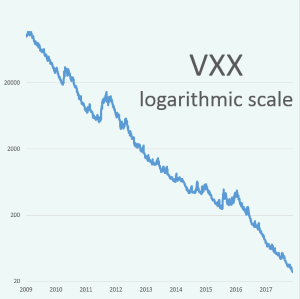

However, since VIX itself is just an index and is not tradable, VXX employs futures on VIX to replicate the desired exposure, and this changes the internal mechanics of this product completely. It demonstrates the positive dynamics only in the short-term – in times of volatility splashes, but during all other, more silent, periods, it is exposed to another very strong factor – volatility term structure. That phenomenon reflects the expectation of the market about the future VIX levels and is captured by the futures on VIX traded on the CBOE Futures Exchange (CFE). Most of the time, the VIX futures are in a contango (the near future price is lower than the further), and VXX constantly diminishes its value by the negative daily “roll yield”.

In this research, we have compared four strategies to exploit the constant downtrend in VXX: buying the inverse VIX ETN – XIV and buying the put options on VXX with different strikes (OTM, ITM, and ATM).

Long Put strategies look appealing due to the inherent downside protection that, theoretically, could lead to the superior risk-adjusted returns. However, the conclusion we have come is that both buying XIV and puts on VXX have almost the same performance measures by the Sharpe ratio, maximum drawdowns, and the shape of equity curves.