All three indices little changed last week staying in the narrow ranges near their local (SPY and QQQ) or all-time (IWM) highs. Today’s political turmoil in Italy has moved SPY slightly lower, provoked some spike in VIX and VXN but has not led to any meaningful reaction in QQQ and IWM.

The mispricing disposition for options on SPY and QQQ has not changed since last week. Options on SPY with expiration 4-5 weeks remain in a quite significant mispricing mode: puts are still substantially overpriced while calls are underpriced. Options on QQQ are priced mostly fairly except for the puts with farther expirations. IWM puts are overpriced in OTM and fairly priced ATM; calls are substantially overpriced in all expirations.

Mispricing summary for the options with two to five weeks until expiration:

| Puts | Calls | ||||

| OTM | ATM | ATM | OTM | ||

| SPY |

Near-term |

Fairly priced |

Fairly priced |

||

|

Farther expirations |

Overpriced substantially |

Overpriced |

Underpriced |

||

| QQQ | Near-term |

Fairly priced |

Fairly priced | ||

|

Farther expirations |

Overpriced |

Fairly priced |

Fairly priced | ||

| IWM | Near-term | Fairly priced | Fairly priced | Overpriced substantially | |

|

Farther expirations |

Overpriced |

Fairly priced | Overpriced substantially | ||

Major opportunities remain mostly in short puts and long calls on SPY. Overpriced IWM calls, especially ATM, can be candidates for selling, including in a covered call strategy.

To make our estimation more reliable, we filter the historical data and select from the past only those dates when the market resembled the current condition (read more here). We use three filters:

For SPY and QQQ, we apply auto filtering for Volatility index and RSI selecting 300 days in history with the shortest Euclidean distance to their current values. For IWM, we use manual filtering since the current regime is not typical due to the relatively low implied volatility (RVX index).

For each underlying, we select expirations on a range of 2-5 weeks and present options Fair Values and Market Prices, both historical (red line) and current real-time (green line). The market prices of these two types can sometimes diverge from each other if the current market condition (volatility surface) differs from its average state in the history.

SPY has spent last week in a narrow range but is declining somewhat today as a reaction to the political turmoil in Italy; RSI(14) has returned closer to 50 level demonstrating neither oversold nor overbought condition.

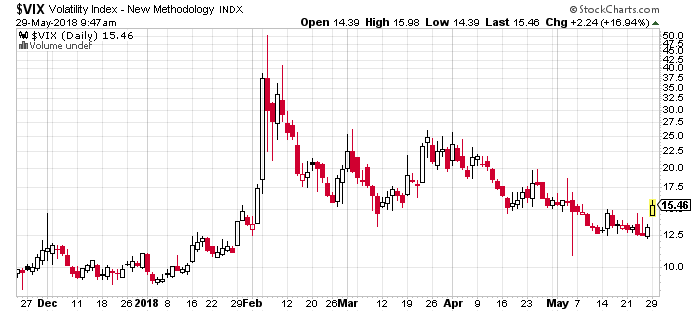

VIX has been hovering around its lows since January this year and jumped today as a consequence of the market drop:

Puts are fairly priced; calls are underpriced but not significantly:

Puts are overpriced in the OTM area; ATM puts and calls are fairly priced. Market prices are adjusted for the June 15 dividend.

Puts are overpriced, especially OTM; calls are underpriced: Market prices are adjusted for the June 15 dividend

Puts are substantially overpriced; calls are underpriced. Market prices are adjusted for the June 15 dividend

QQQ has also been fluctuating within the narrow range near the local highs, did not respond to the Italian events today; RSI(14) shows slightly overbought conditions:

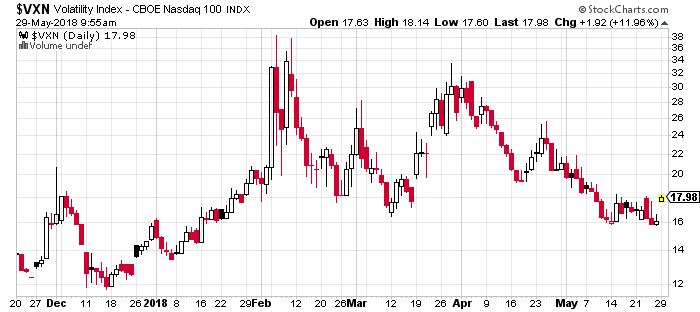

VXN has been staying at the lows since January this year, jumped today to the upper bound of the recent range (16-18):

Both puts and calls are priced fairly:

Both puts and calls are priced fairly:

Puts are overpriced OTM; ATM puts and calls are priced fairly. Market prices are adjusted for the June 18 dividend.

Puts are overpriced OTM; ATM puts and calls are priced fairly. Market prices are adjusted for the June 18 dividend

IWM has tried to test the support line on 160 today but bounced back; RSI(14) demonstrates slightly overbought condition:

RVX has been staying near its lows since January not reacting to the Italian events today:

Puts are priced fairly; calls are substantially overpriced:

OTM puts are overpriced, ATM puts are priced fairly; calls are substantially overpriced:

OTM puts are overpriced, ATM puts are priced fairly; calls are substantially overpriced:

OTM puts are overpriced, ATM puts are priced fairly; calls are substantially overpriced: