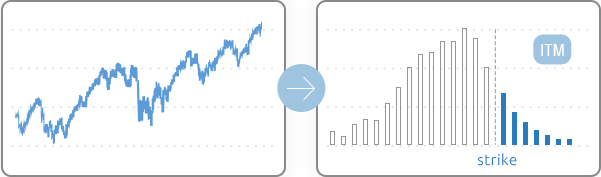

Can past data be a reliable source for the future? Out-of-sample test for Fair Values validity.

Can past data be a reliable source for the future? Out-of-sample test for Fair Values validity.

Puts are systematically overpriced but provide a cushion against volatility. Can they improve the total compounded return?

How would the Fair Values and “volatility smile” of hypothetical Bitcoin options look like?

Calls selling in Bull Markets has negative expected profit. Is there a way to make Covered Calls efficient?

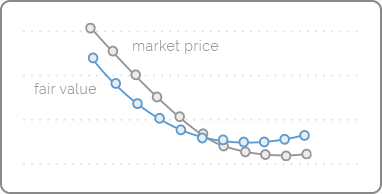

Selling puts on equity indices are very profitable on average. But high volatility with huge negative “fat tails” makes it not so attractive

VXX is an ETP designed for VIX exposure. But due to contango in VIX futures, its value is constantly diminishing. Does that make puts attractive?

Calls on equity indices are fairly priced on average. Selling them adds nothing to the portfolio expected profit but decreases its volatility.